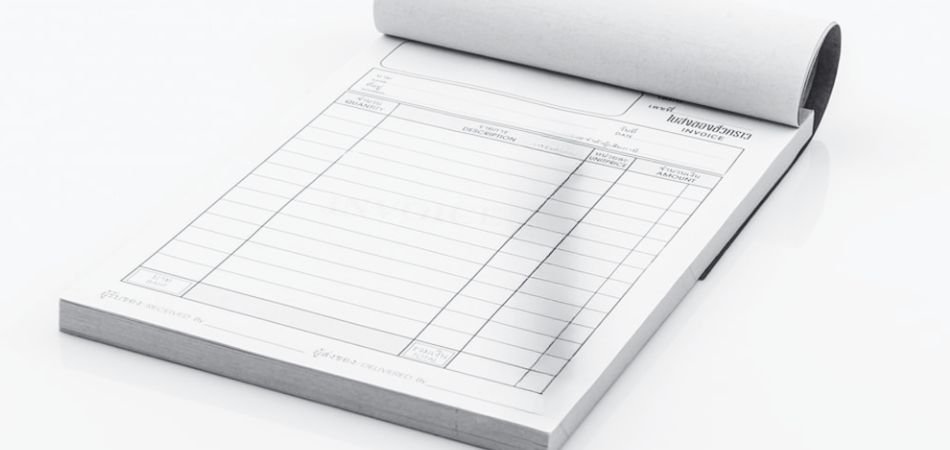

Effective record keeping and organisation are vital for any business’s financial management. Personalised invoice books play a crucial role in enhancing record keeping and organisation processes.

In this blog post, we will explore the benefits of using customised invoice books and discuss how they contribute to efficient record keeping. We will delve into the various features, such as pre-printed sections for customer information, order details, and payment tracking, which simplify accounting processes and streamline business operations.

By the end of this article, you will understand the significant advantages personalised invoice books offer in improving record keeping and organisation.

The Foundation of Efficient Record Keeping

Accurate and organised record keeping is essential for any business to maintain financial stability and comply with legal requirements. Personalised invoice books serve as the foundation for effective record keeping. By using customised invoice books, businesses can ensure that essential information is systematically recorded and easily accessible when needed.

These books provide a dedicated space for recording transactions, tracking sales, and managing customer information. Let’s explore how personalised invoice books contribute to efficient record keeping and organisation.

Pre-Printed Sections for Customer Information

One of the key features of personalised invoice books is the inclusion of pre-printed sections for customer information. These sections typically consist of fields such as customer name, address, contact details, and tax identification number. By having this information readily available, businesses can streamline the process of creating and sending invoices.

It eliminates the need to repeatedly write or type customer details, reducing the chances of errors and saving valuable time.

Additionally, pre-printed customer information sections in invoice books facilitate effective customer relationship management. Businesses can refer back to previous transactions, track customer preferences, and offer personalised service based on historical data.

This feature fosters stronger customer relationships and enhances overall customer satisfaction.

Order Details and Itemisation

Customised invoice books often include dedicated sections for recording order details and itemisation. These sections allow businesses to itemise products or services sold, quantity, unit price, and any applicable discounts.

By clearly documenting the details of each transaction, businesses can accurately track sales, analyse profitability, and reconcile inventory. Furthermore, the itemisation feature ensures transparency and helps in resolving any discrepancies that may arise during the invoicing process.

In addition to order details, personalised invoice books provide spaces for including purchase order numbers, project references, or any other relevant information specific to the transaction.

This level of customisation ensures that all necessary information is captured within the invoice, reducing the risk of confusion or miscommunication.

Payment Tracking and Reminders

Tracking payments is a critical aspect of financial management for any business. Personalised invoice books often include sections dedicated to recording payment information. These sections typically allow businesses to track payment dates, methods, and amounts received.

By systematically documenting payment details within the invoice book, businesses can easily identify outstanding payments, monitor cash flow, and send timely payment reminders to clients.

The inclusion of payment tracking features in personalised invoice books streamlines the collection process and reduces the chances of missed or delayed payments. It also enables businesses to generate reports on outstanding invoices and monitor their accounts receivable effectively.

Sequential Numbering and Audit Trail

Personalised invoice books commonly incorporate sequential numbering, providing a unique identifier for each invoice. Sequential numbering is crucial for maintaining an audit trail and ensuring that no invoice is overlooked or duplicated.

It simplifies the process of cross-referencing invoices with corresponding payments, facilitating accurate record keeping and minimising the risk of fraud or errors.

By maintaining a sequential numbering system, businesses can quickly locate specific invoices, track transaction history, and facilitate auditing or reconciliation processes. It also enhances accountability and transparency, as the sequential numbering creates a clear chronological order for all invoices issued.

Customisation for Specific Business Needs

Personalised invoice books offer businesses the opportunity to customise the layout and content according to their specific needs. This customisation can include incorporating additional fields or sections that are relevant to the business’s industry or unique requirements.

For example, a service-based business may include sections for tracking hours worked or detailing the specific services provided.

By tailoring the invoice book to the specific needs of the business, record keeping and organisation become more efficient. Customisation ensures that the invoice book captures all the necessary information for accurate financial reporting and analysis.

It eliminates the need for businesses to rely on separate systems or manual record-keeping methods, reducing the chances of information getting lost or overlooked.

Integration with Accounting Software

Many personalised invoice books can be designed to integrate seamlessly with accounting software. This integration enables businesses to streamline their record-keeping processes even further.

By connecting the invoice book with accounting software, businesses can automatically import invoice data, eliminating the need for manual data entry and reducing the likelihood of errors.

Integration with accounting software also enables real-time updates of financial information. As invoices are generated and payments are received, the corresponding data is automatically recorded in the accounting system, ensuring that the business has an up-to-date view of its financial position.

This integration saves time, improves accuracy, and allows for more efficient reporting and analysis.

Personalised invoice books offer numerous benefits when it comes to improving record keeping and organisation for businesses. The pre-printed sections for customer information, order details, and payment tracking streamline the invoicing process and ensure accuracy. Sequential numbering and customisation options further enhance organisation and accountability.

By using personalised invoice books, businesses can efficiently maintain transaction records, track sales, monitor cash flow, and strengthen customer relationships. The integration with accounting software takes record keeping to the next level, offering real-time updates and eliminating manual data entry.

Investing in personalised invoice books demonstrates a commitment to professionalism and effective financial management. They not only improve record keeping and organisation but also contribute to a more streamlined and efficient business operation overall.

With these benefits in mind, businesses can make informed decisions and leverage personalised invoice books to optimise their financial processes.

Also Read : What Does NCR Stand For In Printing? Simply Explained